How Rental Yield Works in Cape Verde Real Estate

## Understanding Cape Verde Rental Yield Explained

Cape Verde rental yield explained is essential for investors seeking predictable ROI in one of Africa’s fastest‑growing island markets. This guide provides an analytical breakdown of how rental returns are calculated, what affects them, and how to project long‑term profitability.

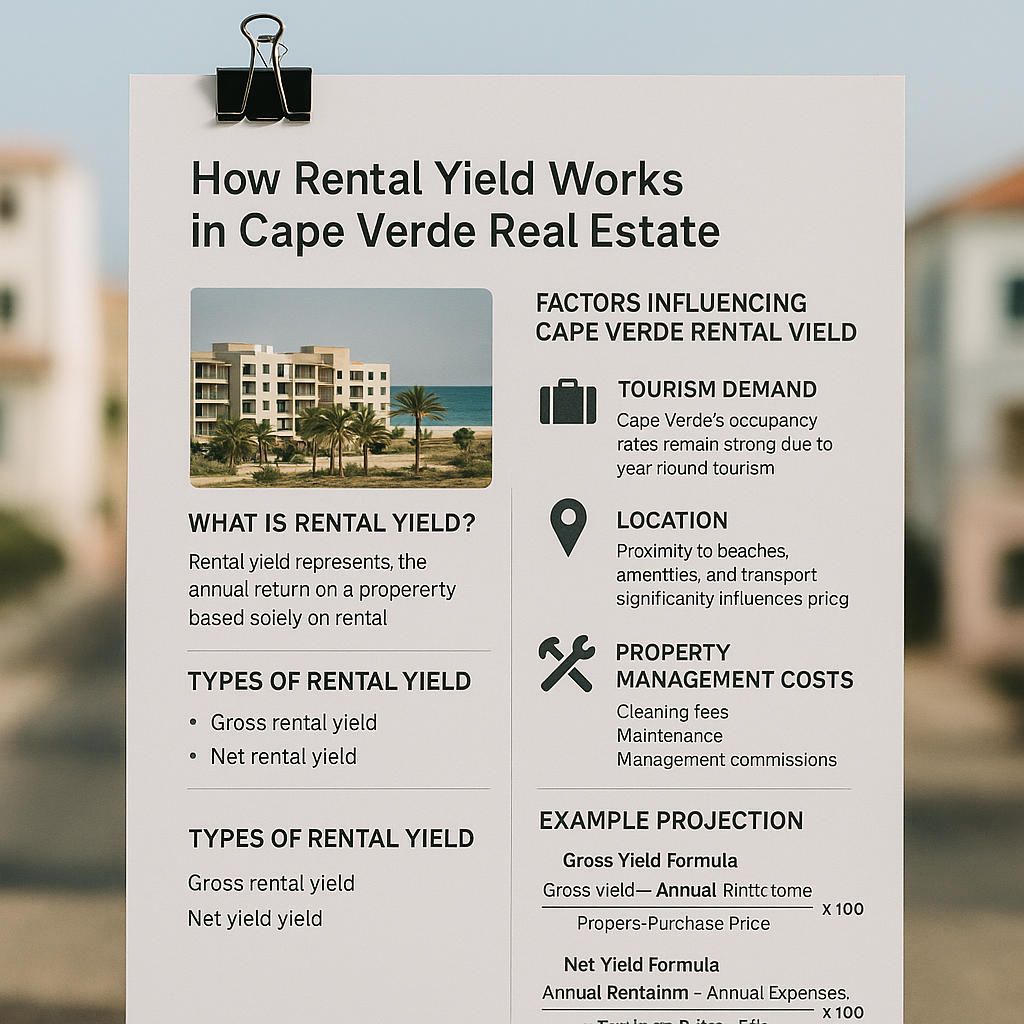

### What Is Rental Yield?

Rental yield represents the annual return on a property based solely on rental income.

### Types of Rental Yield

- Gross rental yield

- Net rental yield

## Factors Influencing Cape Verde Rental Yield Explained

### Tourism Demand

Cape Verde’s occupancy rates remain strong due to year‑round tourism.

### Location

Proximity to beaches, amenities, and transport significantly influences pricing.

### Property Management Costs

Net yield is impacted by:

- Cleaning fees

- Maintenance

- Management commissions

Astuce: Always calculate net yield, not just gross yield.

## Calculating Cape Verde Rental Yield Explained

### Gross Yield Formula

Gross Yield = (Annual Rental Income / Property Purchase Price) × 100

### Net Yield Formula

Net Yield = (Annual Rental Income – Annual Expenses) / Purchase Price × 100

### Example Projection

Assume a €120,000 apartment renting at €110/night with 65% occupancy.

## ROI Benchmarks and Market Data

External reference: tourism arrivals data available at Statista shows stable long‑term demand.

## Where to Invest for Strong Rental Yield

Internal resources such as the listings in Sal Rei help identify high‑performance rental zones.

Discover properties here: [cape verde rental yield explained](https://buyincapeverde.com/properties/boa-vista/sal-rei)

### Notable Investment Zones

- Sal Rei (Boa Vista)

- Santa Maria (Sal)

À retenir: Coastal areas consistently outperform inland zones.

## Final Recommendations for Investors

- Analyse occupancy data

- Compare property types

- Review management service options